Background

Every company with many employees on business trips or many sales representatives knows the problem: at the end of each month, the statement from the respective credit card provider arrives on time. However, the corresponding receipts (fuel bills, train tickets, etc.) only arrive bit by bit. The subsequent reconciliation of the statement with the receipts and the posting in the ERP system used ties up enormous time resources and therefore also personnel costs in the back office and is also often heavily paper-based. In this article, we will show you our approach to this problem and present our solution using robotic process automation.

The initial situation

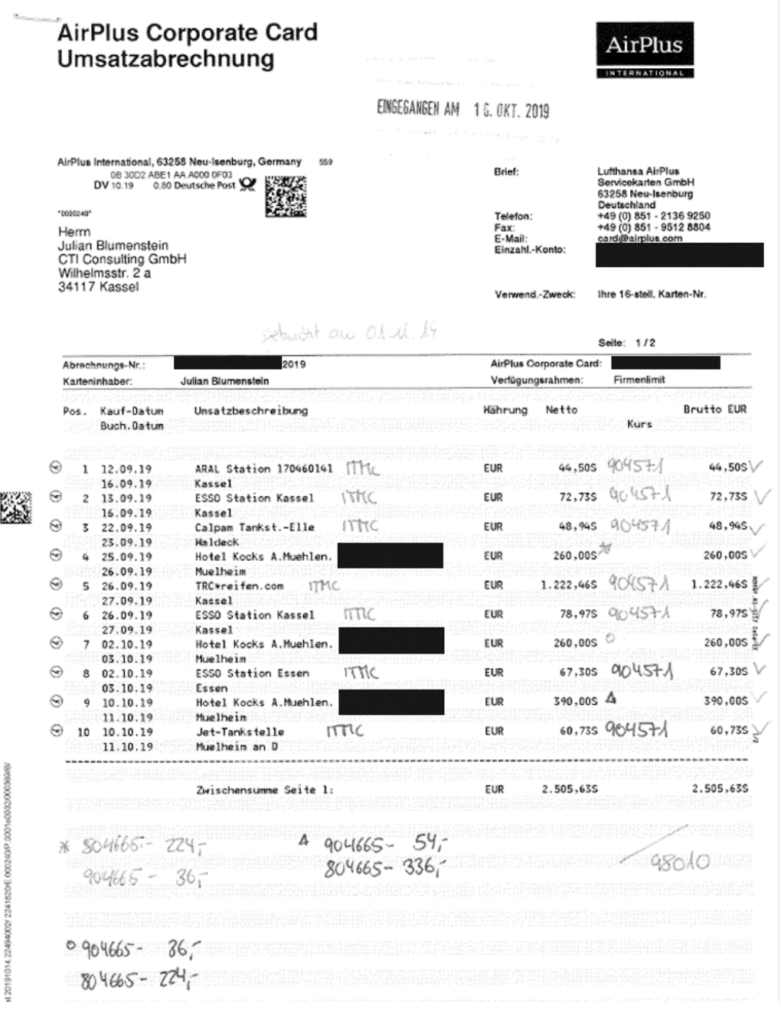

Before the implementation of our bot, the majority of credit card statements were handwritten. The invoice from the credit card provider (in the case of CTI Consulting: Airplus) was sent as a printout by post. An employee from our back office then noted all the information relevant to the booking on this printout (Fig. 1):

- Allocation of the account

- Assignment of the project abbreviation

- Breakdown of the invoice totals according to different tax rates (e.g. hotel breakfast and hotel overnight stay)

- Tick whether a corresponding receipt is available

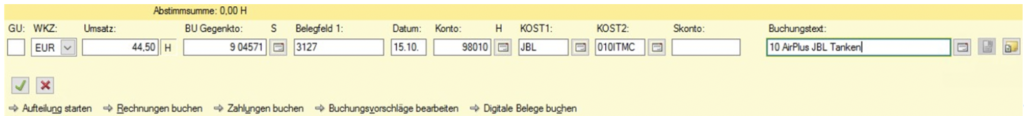

The information created in this way must then be posted in the DATEV accounting system (Fig. 2). In travel-intensive months, this can involve hundreds to thousands of individual postings, each with nine mandatory fields to be filled in.

This highly manual process was time-consuming and error-prone. For this reason, credit card processing was generally reserved for an experienced accountant. In the event of vacation or illness, the process was difficult to delegate. In addition, the process is monotonous, but at the same time very tiring due to the care required.

Solution approach: Partial automation of credit card billing with RPA (UiPath)

In order to relieve the accounting department of the aforementioned monotonous, tedious work steps involved in credit card accounting, various scenarios for the partial automation of the process were evaluated. It quickly became apparent that complete automation of the process would be difficult or even impossible, as the accounting department’s knowledge of ongoing customer projects or the individual travel preferences of employees is extremely helpful in processing. In addition, the formats of receipts, e.g. hotel invoices, are so different that reading them using conventional OCR technologies (e.g. splitting the invoice amount according to different VAT rates) was not expedient.

Instead, the aim was to use bots to provide the accounting department with tools to support them in their work:

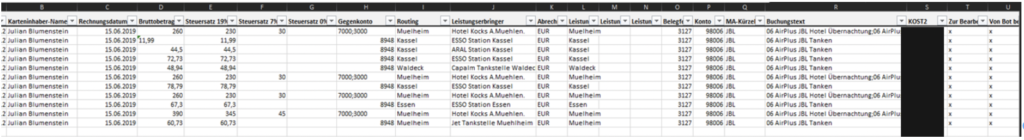

Firstly, a switch was made from paper-based to Excel-based processing. To do this, the bot automatically downloads the current credit card statement for all company credit cards as a package in csv format from the credit card provider’s portal on a fixed date and transforms it into a processing Excel. All the information contained in the statement is transferred and entered into the corresponding cells. In some cases, the values are already adapted to the formats required for processing or posting in DATEV, for example the credit card number is shortened to the last four digits. In addition, fields are generated that are required for posting, such as the posting text (month + credit card provider + employee abbreviation + type of receipt).

To further speed up processing, business rules have been defined for frequently occurring cases, according to which the processing Excel is pre-filled by the bot. This can significantly reduce the processing time again. For example, the account for fuel receipts can be automatically pre-filled, e.g. 948808 if ARAL appears in the “Service provider” column.

These rules were created in text files so that they can be adapted and expanded by the accounting department itself without having to adapt the bot itself or tie up development capacity. Accordingly, the degree of automated filling increases with increasing knowledge of travel habits and typical service providers. The accountant therefore takes on the role of data analyst rather than simply posting data.

As soon as the accountant has finished editing a line in the processing Excel and has assigned the corresponding receipt, he sets the release flag. Based on all approved entries, the bot creates and executes a batch import in the target format of DATEV. In principle, the solution is independent of the ERP system, only the import format needs to be adapted. An import via APIs would also be conceivable. If the booking was successful, the bot writes an entry with the exact time of the booking back into the processing Excel. This means that the accounting department can process the credit card statement step by step. This is particularly helpful as practice shows time and again that employees submit receipts late. In addition, the processing Excel is a good reporting tool for the status of the monthly statement, the traceability of postings and the employee’s voucher discipline.

Conclusion

The partial automation of credit card billing with RPA and the rule-based pre-filling of booking-relevant data drastically reduced the workload of the accounting department, particularly with regard to the monotonous transfer of values. The solution created was proactively driven forward by the employees in the accounting department and many other ideas were contributed during the development process. In summary, the following results were achieved:

- The processing time of the entire monthly credit card statement was reduced by approx. 70%.

- Amortization of the investment in less than 5 months with an assumed 200 bookings per month (in reality significantly more).

- The accounting department was noticeably relieved and dependence on individual employees was reduced.

- The traceability of postings was significantly increased by replacing the paper-based approach.

- The solution created can be expanded to include other/additional credit card providers (e.g. American Express, Master Card, etc.) with manageable effort.

- The solution created can be adapted to new target systems, e.g. SAP ERP etc., with manageable effort.

- And most importantly: The imagination for further RPA solutions was awakened, in the spirit of the saying: “The appetite comes with eating!”

Our service offer

CTI Consulting supports its customers in exploiting their full automation potential along their value chains. Our support ranges from process selection (workshops) and evaluation of RPA benefits (CTI RPA Fit Framework) to analysis of the systems involved and agile implementation of the RPA software robots. With our many years of experience in the areas of enterprise architecture management and business process management, we will lead your RPA project to success. In addition, we support customers in the selection of RPA tools and in setting up an RPA Competence Center within the company.